Completely digital

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Understanding what is a bank guarantee helps businesses secure leases and contracts without tying up working capital. It is a bank’s promise to pay a beneficiary if the applicant fails to meet agreed obligations. The instrument substitutes for a cash bond while preserving liquidity.

MyGuarantee offers secure, cost-effective and sustainable digital bank guarantees through an efficient and responsive application process - delivering speed, transparency, accuracy and security.

Digital requests and confirmation with beneficiaries

Cash secured with Perpetual and AMP

No application fee and no recurring fees

Everything you need to deliver a complete MyGuarantee experience.

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Once onboarding is complete, guarantees can be created, approved and activated in hours.

Bank-grade encryption, verification, and role-based access controls across every action.

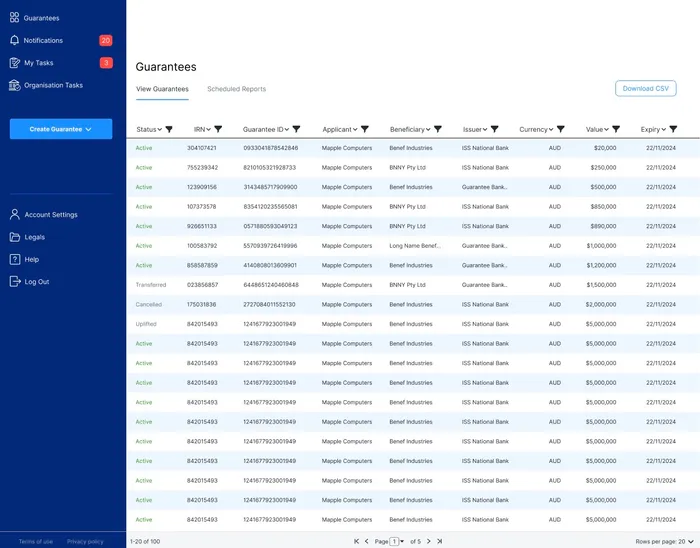

Real-time status from application to issuance, amendments and cancellation.

Customisable reports for audit and operations.

Instant email and dashboard notifications on status changes and required actions.

Clear visibility over every step to build trust with applicants and beneficiaries.

Single place to view, manage and download digital guarantees and related files.

Immutable, time-stamped logs of changes and approvals - auditor-ready, always.

A contract sets the obligations, amount, and expiry. The applicant requests an instrument naming the beneficiary and purpose. If the applicant defaults, the beneficiary can demand payment up to the stated maximum. The bank then pays according to the instrument’s terms.

Banks review eligibility before issuing the instrument. They assess financial position, existing facilities, and documentation. Once approved, the guarantee is created and delivered. With MyGuarantee, creation and delivery are digital, traceable, and managed from one secure platform with real-time status.

Guarantees support commercial leases, construction projects, equipment rentals, and government tenders. They build confidence for beneficiaries while helping applicants avoid large cash deposits. Clear wording and verified delivery reduce disputes at draw time and speed acceptance across stakeholders and sites.

For landlords, guarantees offer predictable, bank-backed security. For tenants and contractors, they preserve cash for operations. Portfolio teams gain consistency and visibility. Digital workflows add speed and reduce handling risks, which is crucial for tight commencements and multi-entity programs.

The applicant remains liable to the bank if the bank pays a claim. Facilities may require cash margins or collateral. Incorrect wording or presentation rules can delay acceptance. Poor record-keeping can also complicate amendments, reductions, and releases at lease end.

Paper handling increases the risk of loss or forgery. Scanned copies are harder to validate. Manual processes slow approvals and create version confusion. A controlled, digital environment mitigates these issues with verification, access controls, and immutable audit logs across every action.

Traditional providers often charge establishment fees and ongoing percentage fees. Courier and re-papering expenses can add up over time. Transparent bank guarantee fees matter because they affect project budgets and tender pricing, especially where terms or values change during delivery.

MyGuarantee is designed to minimise friction and surprises for applicants. Issuance, amendment, and release are online, reducing administrative effort. Same-day processing is available once onboarding is complete. That reduces indirect costs linked to delays, branch visits, and physical distribution.

MyGuarantee distributes bank-issued instruments on behalf of AMP Bank. The platform provides bank-grade encryption, role-based access, and full traceability. Beneficiaries can validate authenticity immediately, improving acceptance and confidence while lowering fraud risk across portfolios and counterparties.

Stakeholders see the same live record. Notifications highlight required actions. Reductions and cancellations are handled in-platform. This aligns finance, legal, and property while removing courier dependencies. It also creates a reliable evidence trail for audits, tenders, and governance reviews.

Applicants and beneficiaries must hold an ABN or ACN. The instrument must be for a business purpose and issued in AUD. Any Australian entity type is supported, including government bodies. These checks keep approvals efficient and prevent avoidable deferrals during review.

Start an application on the platform. Complete identity verification and provide required information. Receive the approval response in your dashboard. Issuance proceeds digitally, with live tracking and secure, role-based workflows connecting all participants and reducing manual hand-offs.

The experience replaces paper with modern controls. There is no need for a separate digital bank guarantee form download because fields are captured in-platform. Beneficiaries verify authenticity online. That reduces disputes and ensures everyone acts on the current, verified instrument.

Many organisations now use online bank guarantees to remove courier delays and regional bottlenecks. MyGuarantee supports a digital bank guarantee online experience that’s fast, transparent, and secure. Same-day processing supports urgent timelines and complex commencements across multiple sites.

Teams often ask about an instant bank guarantee online. Speed depends on onboarding and approvals, but digital workflows compress timelines significantly. Live status and alerts keep projects moving, while audit-ready logs provide accountability without extra effort or fragmented email trails.

Commercial landlords and tenants simplify lease security and reduce handling risk. Construction firms align reductions to project milestones. Equipment lessors gain predictable processes. Government contractors improve traceability for compliance reviews. SMEs and large corporates both benefit from guided steps and portfolio reporting.

MyGuarantee also strengthens assurance with digital identity verification and biometric checks. Funds are released only after thorough due diligence. Centralised verification and controlled delivery reduce impersonation risk and eliminate uncertainty around altered paper copies or detached scanned documents.

It is a bank promise to pay a beneficiary if obligations aren’t met. The beneficiary can demand payment up to a stated amount, subject to the instrument’s terms and presentation rules. Digital delivery improves verification and speeds acceptance.

If the bank pays a valid claim, the applicant owes the bank. Facilities may require collateral. Process risks include incorrect wording, lost documents, or weak verification. Digital controls and clear acceptance language reduce these risks materially.

Potential fees, collateral requirements, and administrative complexity can impact timelines and budgets. Paper handling introduces fraud and loss risk. Digital issuance mitigates these issues by enabling instant verification, online amendments, and dependable audit trails.

Traditional models often include establishment and ongoing percentage fees, with extra costs for paper handling and re-issuance. MyGuarantee streamlines the process digitally, reducing indirect costs tied to delays, couriers, and manual administration.

If you’re ready to modernise how you manage what is a bank guarantee, book a short demo. See how MyGuarantee delivers secure, same-day, digital issuance with clear visibility and governance. Bring certainty, speed, and control to every transaction by digitising what is a bank guarantee end to end.

Book a demo today!We use essential cookies to make our site work, and optional analytics & marketing cookies to improve your experience. See our Privacy Policy.