Completely digital

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Businesses often ask where to get a bank guarantee that’s fast, secure, and easy to manage. The answer depends on your needs, risk profile, and timelines. This guide compares options and explains why a digital, bank-issued instrument can streamline approvals and reduce operational risk.

MyGuarantee offers secure, cost-effective and sustainable digital bank guarantees through an efficient and responsive application process - delivering speed, transparency, accuracy and security.

Digital requests and confirmation with beneficiaries

Cash secured with Perpetual and AMP

No application fee and no recurring fees

Everything you need to deliver a complete MyGuarantee experience.

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Once onboarding is complete, guarantees can be created, approved and activated in hours.

Bank-grade encryption, verification, and role-based access controls across every action.

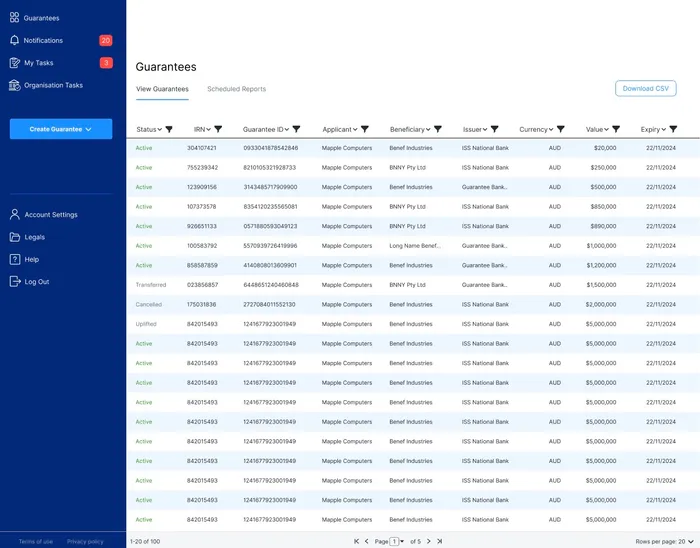

Real-time status from application to issuance, amendments and cancellation.

Customisable reports for audit and operations.

Instant email and dashboard notifications on status changes and required actions.

Clear visibility over every step to build trust with applicants and beneficiaries.

Single place to view, manage and download digital guarantees and related files.

Immutable, time-stamped logs of changes and approvals - auditor-ready, always.

Start by clarifying what is a bank guarantee in practice: it is a bank’s promise to pay a beneficiary up to a stated amount if obligations aren’t met. You select a provider, agree terms, and the bank issues the instrument to your counterparty.

You can obtain a guarantee from your existing business bank. You can also use a specialist platform connected to a bank. MyGuarantee is a digital distributor for AMP Bank, delivering bank-issued instruments with modern controls, visibility, and faster turnaround.

MyGuarantee suits commercial landlords and tenants, builders, equipment lessors, and government contractors. Large corporates and SMEs gain standardised workflows. No paper handling is required. Amendments occur in real time, so teams avoid re-papering and courier delays entirely.

The platform centralises drafting, approvals, and release. Stakeholders collaborate without scattered emails or version confusion. Digital distribution reduces fraud exposure and missing originals. Bank-grade encryption and role-based permissions maintain control across every action, user, and document.

Confirm that both the applicant and beneficiary have an ABN or ACN. Ensure the purpose is business-related. Guarantees must be denominated in AUD. These checks keep reviews efficient and prevent unnecessary deferrals at approval time.

You apply on the platform, completing identity verification and required information. MyGuarantee submits to AMP Bank for approval. Once approved, issuance proceeds digitally. Counterparties receive a bank-issued instrument they can validate and administer online from day one.

MyGuarantee’s controls include digital identity verification and biometric checks. Funds are only released after thorough checks. This reduces fraud risk while preserving speed. Live status, notifications, and audit logs create transparency for finance, legal, and operations.

Some teams ask about bank guarantee vs security deposit when assessing cost and flexibility. A bank guarantee preserves working capital and offers on-demand claims. Digital issuance adds speed and traceability, which helps multi-site portfolios and complex approval chains.

Traditional paper processes introduce delays and handling risks. Digital instruments enable instant delivery and standardised amendments. That consistency reduces disputes and administration. It also improves audit readiness because every action is visible and time-stamped for reviewers.

Landlords and procurement teams prefer instruments they can validate instantly. With MyGuarantee, beneficiaries can verify bank guarantee online in a controlled environment. If you’re wondering how to verify bank guarantee online, the platform provides a secure verification path with clear guidance.

Centralised verification removes reliance on emailed scans and ad-hoc calls. It increases confidence at draw time and during amendments. It also accelerates acceptance because counterparties can confirm authenticity without waiting for original paper documents.

Choose a provider, prepare beneficiary details, amount, expiry, and purpose. Submit financials and identification. With MyGuarantee, complete the digital checks, receive approval, and proceed to online issuance with live tracking and role-based permissions.

Banks issue guarantees. Platforms like MyGuarantee facilitate digital creation and management while distributing on behalf of AMP Bank. This combines bank assurance with modern workflows and portfolio visibility.

Yes. MyGuarantee enables an online bank guarantee experience. Once onboarding is complete, issuance can occur the same day, subject to approvals. Beneficiaries validate authenticity digitally, which speeds property, procurement, and contract processes.

“Best” depends on speed, acceptance, and controls. Many organisations prefer AMP Bank instruments delivered through MyGuarantee. You gain bank-issued assurance with digital issuance, amendments, and verification, backed by secure workflows and an enterprise-ready audit trail.

Urgent commencements and tenders demand fast issuance and clean acceptance. Digital delivery limits logistics bottlenecks and regional delays. Standardised wording and amendment paths keep stakeholders aligned, especially across national portfolios and multi-entity structures.

If you are deciding where to get a bank guarantee, consider your approval speed, verification needs, and governance expectations. MyGuarantee delivers digital bank guarantees Australia with strong security, real-time tracking, and streamlined collaboration.

Book a short demo to align teams, modernise workflows, and solve where to get a bank guarantee decisively.

Book a demo today!We use essential cookies to make our site work, and optional analytics & marketing cookies to improve your experience. See our Privacy Policy.