Completely digital

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Businesses need fast, reliable bank guarantee verification online to prevent fraud, accelerate acceptance, and keep projects moving. Verification should be immediate, auditable, and simple for beneficiaries and applicants. MyGuarantee delivers that with a secure, paperless process backed by AMP Bank and fee-free digital issuance.

MyGuarantee offers secure, cost-effective and sustainable digital bank guarantees through an efficient and responsive application process - delivering speed, transparency, accuracy and security.

Digital requests and confirmation with beneficiaries

Cash secured with Perpetual and AMP

No application fee and no recurring fees

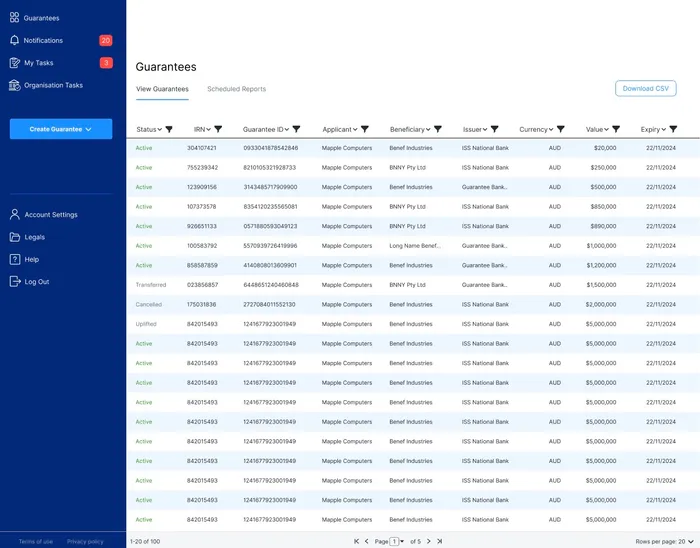

Everything you need to deliver a complete MyGuarantee experience.

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Once onboarding is complete, guarantees can be created, approved and activated in hours.

Bank-grade encryption, verification, and role-based access controls across every action.

Real-time status from application to issuance, amendments and cancellation.

Customisable reports for audit and operations.

Instant email and dashboard notifications on status changes and required actions.

Clear visibility over every step to build trust with applicants and beneficiaries.

Single place to view, manage and download digital guarantees and related files.

Immutable, time-stamped logs of changes and approvals - auditor-ready, always.

Paper originals can be lost or altered. Email attachments create uncertainty. A digital workflow removes these risks. Beneficiaries view the instrument in a controlled environment and confirm authenticity instantly. That reduces disputes at draw time and speeds lease or contract execution.

Verification also improves governance. Every access and action is time-stamped. Finance, legal, and operations see the same source of truth. Portfolio teams resolve queries faster because status, comments, and history live together. That strengthens assurance without adding administrative burden.

MyGuarantee distributes AMP Bank instruments digitally. Beneficiaries receive a secure link to the live record. They confirm parties, amount, and wording in seconds. If terms change, updates publish immediately, so everyone acts on the current, verified version without re-papering or couriers.

Controls are bank-grade. Digital identity checks and biometric verification protect access. Funds release only after thorough diligence. This approach supports verify bank guarantee online requirements for landlords, procurement teams, and government bodies that demand clear, auditable evidence.

Issuance is same day once onboarding is complete. There are no application or recurring fees for applicants. That matters for urgent commencements and tenders. Faster confirmation means fewer hold-ups, reduced site delays, and cleaner hand-offs between property, legal, and finance teams.

The process is cash secured with Perpetual and AMP. Role-based access limits who can act, approve, or amend. Notifications keep stakeholders aligned. Digital records remain searchable and exportable, so audit packs assemble quickly when reviewers ask for evidence or transaction history.

Clear wording prevents friction. Many landlords rely on a landlord bank guarantee requirements template to set acceptance rules. Map those clauses to MyGuarantee fields during creation. Verification then becomes a simple confirmation exercise, not a negotiation about phrasing or jurisdiction.

This discipline helps across portfolios. Standard terms speed approvals and cut rework. When obligations change, digital amendments publish instantly. Beneficiaries confirm updates online, which maintains alignment and reduces the risk of drawing on outdated instruments.

A digital guarantee is not a scanned PDF. It is created, issued, amended, and released online. That enables immediate validation, traceable approvals, and real-time reductions. It also supports stronger fraud controls than paper mail-outs and unmanaged email chains.

Organisations that adopt online bank guarantees see fewer operational bottlenecks. They avoid courier delays and misplaced originals. They also gain reliable portfolio reporting. That combination improves cash-flow certainty for beneficiaries and planning accuracy for applicants.

Apply in MyGuarantee for an AMP Bank instrument. Complete identity checks and submit required information. After approval, the bank-issued document is delivered digitally to authorised parties. Beneficiaries verify authenticity online and monitor any future amendments in real time.

It’s the set of structured details used to create the instrument. In a digital workflow, fields replace static paperwork. You enter parties, amount, purpose, governing law, and expiry. The platform validates entries to reduce errors and accelerate acceptance.

It’s a tool some institutions use to confirm account or identity information. In the guarantee context, MyGuarantee replaces ad-hoc forms with secure, in-platform checks and an auditable verification path that beneficiaries can rely on during issuance and claims.

It presents the bank’s unconditional undertaking, the beneficiary’s legal details, the maximum amount, and key terms. In MyGuarantee, the live digital record displays these elements clearly. Beneficiaries confirm them during bank guarantee verification online without handling paper.

Applicants and beneficiaries need an ABN or ACN. Any Australian entity type is supported. The instrument must be for business purposes and issued in AUD. These simple checks keep reviews efficient and help approvals move quickly to digital issuance.

Trust demands speed and certainty. Choose a solution that delivers auditable, real-time bank guarantee verification online, so stakeholders act with confidence and projects stay on schedule.

Book a demo today!We use essential cookies to make our site work, and optional analytics & marketing cookies to improve your experience. See our Privacy Policy.