Completely digital

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

If you need to apply for a digital bank guarantee, this guide explains the steps, documents, and acceptance wording landlords expect. It also shows how MyGuarantee delivers faster approvals, stronger controls, and clear audit trails for Australian businesses of every size.

MyGuarantee offers secure, cost-effective and sustainable digital bank guarantees through an efficient and responsive application process - delivering speed, transparency, accuracy and security.

Digital requests and confirmation with beneficiaries

Cash secured with Perpetual and AMP

No application fee and no recurring fees

Everything you need to deliver a complete MyGuarantee experience.

End-to-end online workflows - no paper, no postage - reducing time, risk, and environmental impact.

Once onboarding is complete, guarantees can be created, approved and activated in hours.

Bank-grade encryption, verification, and role-based access controls across every action.

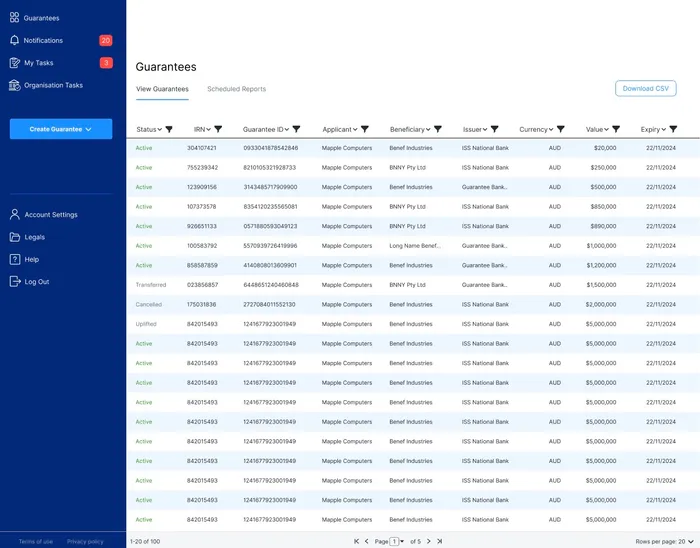

Real-time status from application to issuance, amendments and cancellation.

Customisable reports for audit and operations.

Instant email and dashboard notifications on status changes and required actions.

Clear visibility over every step to build trust with applicants and beneficiaries.

Single place to view, manage and download digital guarantees and related files.

Immutable, time-stamped logs of changes and approvals - auditor-ready, always.

Apply for an AMP Digital Bank Guarantee through the MyGuarantee platform. Complete ID checks and the required information. You’ll receive your approval response in MyGuarantee. Issuance then proceeds digitally, without paper handling, couriers, or branch visits.

MyGuarantee distributes bank-issued instruments on behalf of AMP Bank. Applicants pay no onboarding, application, or recurring fees. Same-day processing is available once onboarding is complete. That speed supports urgent lease commencements and time-critical tenders across complex portfolios.

Confirm both you and the beneficiary hold an ABN or ACN. Any Australian entity type is supported, including government bodies. The instrument must be for business purposes and issued in AUD. These simple checks help you avoid unnecessary back-and-forth later.

When applying for a digital bank guarantee, gather financial statements, income verification, and loan details. Prepare beneficiary information, the maximum amount, and expiry preferences. Align terms with your lease or contract milestones to simplify future reductions and releases.

Speed, security, and transparency are built in. The workflow is end-to-end online, with role-based access and bank-grade encryption. Real-time status, notifications, and immutable logs provide governance and accountability without extra effort for busy teams.

Issuance, amendments, and cancellations are handled in one place. Beneficiaries can verify authenticity instantly, which reduces fraud exposure and disputes. That assurance helps counterparties accept instruments quickly and limits operational risk during claims or changes.

Check the lease clauses covering security instruments. Confirm required wording, governing law, and presentation rules. Capture the beneficiary’s correct legal name and address. Add ABN or ACN entries exactly as registered to prevent avoidable revisions during review.

Plan your expiry date against obligations and options. Many teams set milestone-based reductions for fit-out and rent phases. Digital amendments enable controlled decreases without re-papering. Everyone works from the latest version, which removes confusion and rework.

A modern electronic bank guarantee is easier to issue, manage, and verify than a paper document. It reduces handling risks and courier delays. It also improves acceptance speed because the instrument can be validated online by authorised beneficiaries.

MyGuarantee supports digital bank guarantee Australia use cases across landlords, construction firms, and government contractors. Larger enterprises benefit from portfolio reporting and centralised oversight. SMEs get guided steps and quick turnaround without sacrificing governance or security.

Many ask, what is a digital bank guarantee. It is a bank-issued instrument created and managed online. With MyGuarantee, it’s distributed on behalf of AMP Bank, verified digitally, and tracked with audit-ready logs.

Start in MyGuarantee. Enter parties, amount, expiry, and purpose. Upload supporting documents and complete identity checks. Once approved, issuance occurs digitally, and the beneficiary can validate authenticity immediately.

State the beneficiary, amount, and purpose clearly. Match the lease wording exactly. Attach financials and entity details, including ABN or ACN. MyGuarantee guides these fields and validates entries to prevent errors and delays.

Use the platform’s step-by-step flow. Select the beneficiary, add terms, and submit documents. Approval appears in your dashboard. Issuance, amendments, and cancellations are then managed centrally with notifications to all stakeholders.

Yes, you can obtain a bank guarantee online through MyGuarantee. The experience enables same-day bank guarantee online issuance once onboarding is complete, subject to approvals and standard checks.

When you apply for a digital bank guarantee in MyGuarantee, you gain speed, control, and clarity. If you prefer, you can also apply digital bank guarantee requests directly from a standardised checklist to keep data consistent across sites and projects.

MyGuarantee streamlines approvals with secure workflows and beneficiary verification. Book a short demo to see how applying for a digital bank guarantee becomes faster, safer, and more transparent from creation to release.

Book a demo today!We use essential cookies to make our site work, and optional analytics & marketing cookies to improve your experience. See our Privacy Policy.